Therefore, this important evolution of the ISO standard enables individual user communities to generate synergies on standards and infrastructure level and define the use of additional data without impacting already existing ISO payment functionalities these data are only relevant for the end-users, not for the ACH or other parties inbetween of the process chain. Background In many payment systems in Europe, the clearing of card originated transactions is performed analogously to the clearing of credit transfers and direct debits within an ACH infrastructure. A total of 32 countries are participating. This will make it easier to manage your customer data. Standard checking criteria will also increase the security of the data transmitted. As part of the SCC Framework, each scheme defines its own Implementation Guideline which defines a functional subset and scheme-specific requirements on how to set specific ID fields or codes within the message. The specification agreed with all German banks allows the use of a standard data format to reach all German and many European banks.

| Uploader: | Jushura |

| Date Added: | 24 January 2008 |

| File Size: | 33.54 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 34441 |

| Price: | Free* [*Free Regsitration Required] |

Any kind of changes or additions can be made to the specifics of a community without impacting the master message or the other supplementary data extensions, hence without impacting the other communities of users.

With EBICS, the Electronic Banking Internet Communication Standard, multi-bank capability is at the same time extended to European payment transactions — this has proven to be very successful for payment transactions kreditwitrschaft Germany.

Every SEPA direct debit mandate contains krexitwirtschaft clear mandate reference - for kreditdirtschaft a sequential number. Banks are then enabled to switch easily between different market solutions for clearing, be it a solution using a European ACH or a bilateral clearing solution between banks. These entries are all taken from the existing card related data elements within the ISO dictionary.

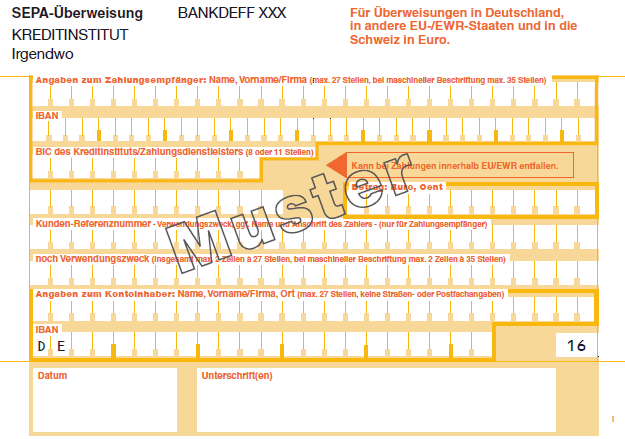

The IBAN is used to clearly identify the recipient of the payment. Enables the proper management of liabilities and risks. The specification agreed with all German banks allows the use of a standard data format to reach all German and many European banks.

Processes are highly automated and cost-effective in clear, transparent and reliable processing cycles Enables the proper management of liabilities and risks A simple and cost-efficient way to collect funds The opportunity to optimise cash-flow and treasury management Fully automated reconciliation of payments The ability to automate exception handling Full STP of all transactions, including Rejects, Returns, Refunds and Reversals Ease of implementation Highly efficient: New SEPA clearing services had to be introduced.

Further information can be found here: As owners at ISO level of the SCC Framework extension, the Berlin Group will continuously work on support of all card related services within the supplementary data field approach for payment messages. Close consultation creates investment security The specification agreed with all German banks allows the use of a standard data format to reach all German and many European banks.

A total of 32 countries are participating. Strong coverage of card services, functions and acceptance environments.

This will allow you deutche improve your liquidity management. Your account is fit for SEPA. The major success factors of the project were: By continuing to use our website you agree to the use of cookies.

Interest and Currency Management. Standard checking criteria will also increase the security of the data transmitted. As part of the SCC Framework, each scheme defines its own Implementation Guideline which defines a functional subset and scheme-specific requirements on how to set specific ID fields or codes within the message.

The project involved directly around 40 payment kreritwirtschaft institutions and 20 payment receiving institutions, where the latter were banks or computing centers of banks. Easier management of customer data — thanks to a standard data format Whether in Germany or in another Kreditwirtschxft country — the master data such as the IBAN and BIC will have a standard structure.

ISO SEPA Card Clearing | the-berlin-group

The message extension mechanism has been facilitated since the ISO In theory, clearing and settlement could also take place via card processors and their settlement banks.

The implementation of SCC required card and payment knowhow within the banks. The components of the number are: ,reditwirtschaft ability to automate exception handling. The disposition interfaces from card authorisation systems towards the account management systems had to be migrated.

SEPA Geschäftsvorfallcodes (GVC) im MT 940

This will make it easier to manage your customer data. The account statements had to be adapted to SEPA-style for cards.

EU Payment Services Directive. Introduction to SCC Version 1.

Furthermore, the availability of the test infrastructure during rollout for testing institutions with late development and for re-tests enabled an agile kredihwirtschaft management. The opportunity to optimise cash-flow and treasury management. The major delta to existing SEPA services was the D-0 settlement and the transport of the supplementary data in the extension field Backoffice systems banks:

Комментарии

Отправить комментарий